Alpha-Climate Fund

ESG Integration: Up to 12 months

Portfolio Fund Target

~ 349,033

Strategy Focus

Sustainable Investing

Target Size

$500m

Investment Objectives

Key Focus Areas:

-

Investments in companies that promote clean energy, carbon neutrality, resource efficiency, and sustainable practices.

-

Prioritizing businesses that uphold fair labor practices, diversity and inclusion, community impact, and corporate social responsibility (CSR) initiatives.

-

Supporting firms with transparent corporate governance, strong leadership ethics, and shareholder rights protection.

Benefits to Investors

-

Sustainable Growth & Resilience: Investing in companies with strong ESG practices enhances long-term financial stability and reduces risks from environmental and regulatory pressures.

-

Lower Risk Exposure: Companies adhering to ESG standards are less likely to face lawsuits, environmental fines, or governance scandals, leading to lower volatility and risk-adjusted returns.

-

Positive Environmental & Social Impact: Investors contribute to climate change solutions, social equality, and corporate responsibility, aligning personal values with financial goals.

-

Long-Term Market Trends Favor ESG Investing: The global shift toward renewable energy, ethical consumerism, and sustainable supply chains ensures continued demand for ESG-focused businesses.

Team

-

James Carter – Chief Investment Strategist: James Carter has over 20 years of experience in sustainable investing and financial strategy. Before joining the fund, he served as the Head of ESG Strategy at a top global asset management firm, where he was responsible for integrating ESG factors into multi-asset portfolios.

-

Sophia Patel – Head of Impact Investing: Sophia Patel has 15+ years of experience in impact investing and corporate social responsibility (CSR). She began her career working with development finance institutions (DFIs), structuring impact-driven investments in emerging markets. She later moved to a leading private equity firm specializing in social impact ventures, where she helped fund sustainable startups.

-

David Chen – Senior Portfolio Manager: David Chen is a seasoned ESG investment manager with over 18 years of experience in climate finance and multi-asset investing. He previously worked as a senior portfolio manager at a Fortune 500 investment firm, where he led strategies focused on climate adaptation and sustainable infrastructure.

Highlights

Investment Structure

Investing in this fund allows individuals to make a positive impact on the world while potentially benefiting from financial returns. It reflects a growing awareness of the importance of responsible investing in addressing global challenges and creating a more sustainable future.

Environmental Impact:

The primary objective of the fund would be to generate positive environmental impact by investing in companies that contribute to the preservation of natural resources, reduction of carbon emissions, and overall ecological well-being.

Risk Management:

The Fund priortizes prudent risk management, seeking to mitigate exposure to companies with poor environmental records or those at higher risk due to their dependency on non-renewable resources.

Investor Education and Empowerment:

The fund uniquely emphasizes investor education and empowerment. The objective is to foster informed decision-making by providing educational resources and insights on environmental trends, enabling investors to understand the rationale behind their investments.

Positive Industry Influence:

Through its investments, the fund would aim to influence industries towards adopting more sustainable practices, encouraging a broader positive impact beyond its portfolio holdings.

Transparency and reporting:

The fund would commit to transparently reporting on its environmental impact and financial performance, providing investors with insights into how their investments are contributing to sustainability.

Long term sustainability:

Prioritize investments that not only deliver immediate environmental benefits but also contribute to the long-term sustainability of ecosystems and communities.

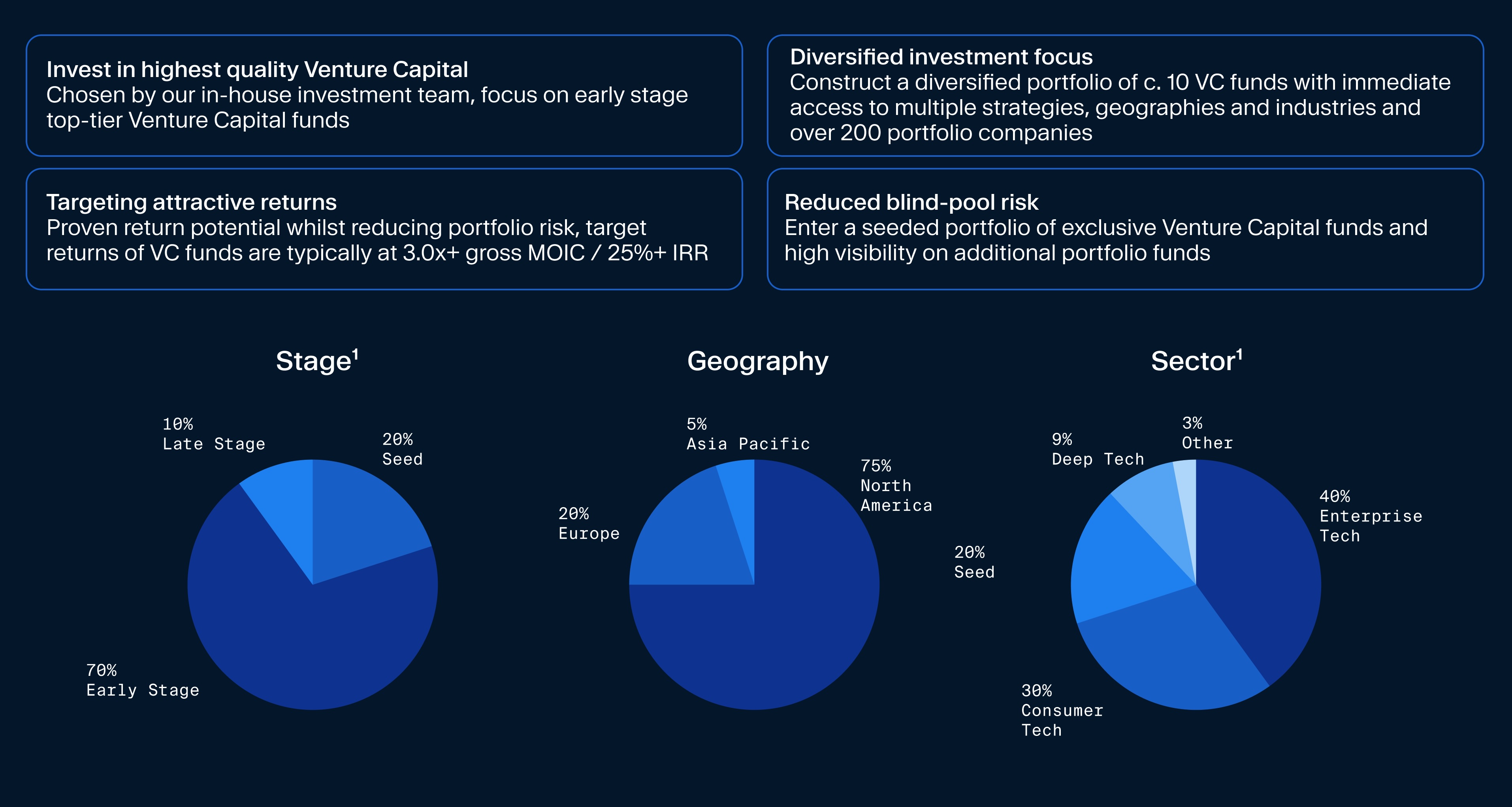

Illustrative Portfolio Diversification

-

INVESTMENT NAME

Alpha-Climate Fund

-

Strategy

Sustainable Investing, Portfolio

-

Geography

Global

-

Investment Period

Up to 12 Month

-

Closing date

2027-01-01

-

Min. Investment

$25,000

-

Max. Investment

$64,999

-

Surge Percentage

1.50 %

-

Surge Duration

4 Week(s)

-

Tri-Weekly Dividend

1.31% - 1.38%

-

Min Withdrawal

$50

-

Max Withdrawal

$10,000

-

Staking Interest

1.46%

-

Diverse Staking Ratio

(SI) 80 : 20 (FB)