Global Ventures III

Tech Equities

Portfolio Fund Target

~ 10,000

Strategy Focus

Emerging Technologies

Target Size

$100m

Global Ventures III – Fund Overview

About Global Ventures III

This is a next-generation, multi-strategy investment fund designed to capture growth across the world’s most transformative sectors — AI, blockchain, global futures, and thematic megatrends. all backed by our performance heritage and strategic insight.

Delle Relationships

490+

Primary Fund Investments in the past year4

75+

Total Fund size

$100 Million +

Investment Objectives

Global Ventures III offers investors access to a high-conviction, multi-strategy fund targeting the sectors shaping the future of global finance — with flexible entry and institutional-grade performance.

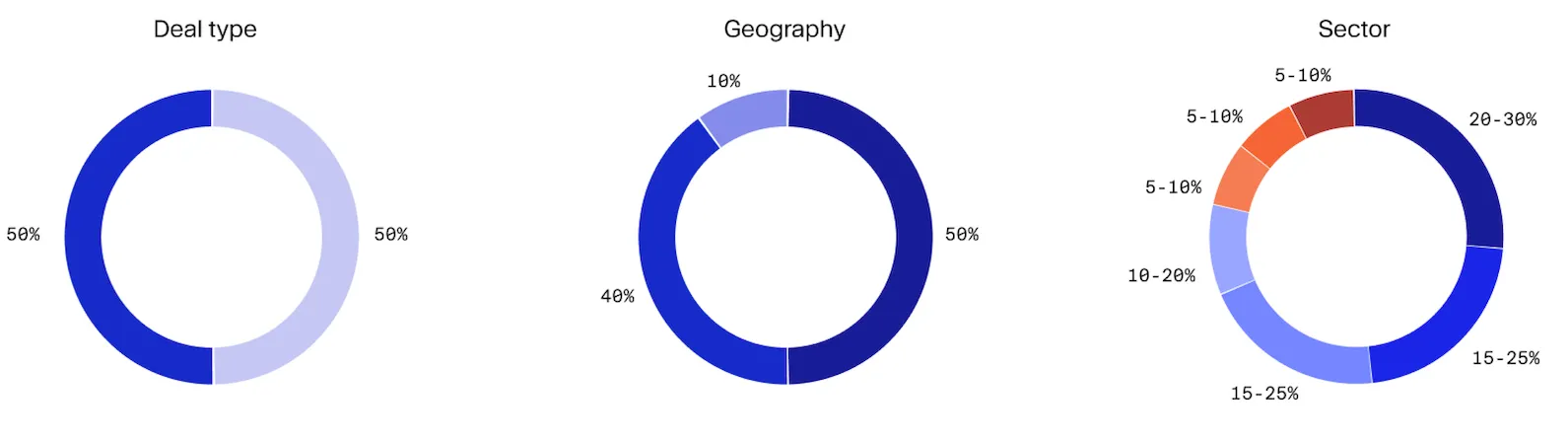

Fund Allocations

Which Strategy Fits Your Clients Best?

Each strategy in Global Ventures III is designed with different investor goals in mind — whether they're focused on steady growth, long-term innovation, or a balanced path forward.

For the Flexible, Tactical Investor

Strategy: Futures Pool Strategy

Best suited for: Clients who want their capital working quickly, with access to regular income and shorter commitments.

Why it fits: With just $5,000 to start, this strategy offers exposure to global futures in commodities, volatility, and momentum. It’s a smart choice for those looking for agility, daily interest, and an 8-month timeline that doesn’t tie them down too long.

For the Tech-Savvy Growth Seeker

Strategy: AI Index Strategy (HFTP Allocation)

Best suited for: Investors who are future-focused and want exposure to the AI revolution.

Why it fits: Starting at $20,000, this strategy gives access to a curated basket of AI and automation leaders, powered by high-frequency trading tech. It’s ideal for clients who want to be ahead of the curve and participate in one of the most transformative themes of this decade.

For the Innovation-First Visionary

Strategy: Blockchain & Emerging Tech Strategy

Best suited for: Clients with a bold, long-term perspective and appetite for disruption.

Why it fits: With a $50,000 entry, this strategy targets early-stage blockchain, tokenized assets, and frontier technologies. It’s perfect for clients looking to tap into the infrastructure layer of tomorrow’s financial and digital ecosystems.

For the Strategic, Macro-Minded Investor

Strategy: Sector Rotation & Thematic Growth

Best suited for: Investors looking to follow big-picture trends like clean energy, defense tech, biotech, and fintech.

Why it fits: At a $100,000 minimum, this strategy offers access to sectors with structural tailwinds and rotating macro themes. Great for clients who want smart, diversified exposure — without having to pick individual stocks or time the market.

Bonus Flexibility – Fixed or Diverse Staking Models

Clients can choose Fixed Staking (capital fully locked for the duration), or Diverse Staking (90% locked, 10% flexible for withdrawals). This makes it easier to match strategies to their liquidity needs.

-

INVESTMENT NAME

Global Ventures III

-

Strategy

Emerging Technologies, Portfolio

-

Geography

North America, Asia, Europe

-

Investment Period

Up to 8 Month

-

Closing date

2025-08-25

-

Min. Investment

$5,000

-

Max. Investment

$3,499,999

-

Surge Percentage

1.80 %

-

Surge Duration

12 Week(s)

-

Tri-Weekly Dividend

0.95% - 1.15%

-

Min Withdrawal

$100

-

Max Withdrawal

$500,000

-

Staking Interest

0.80%

-

Diverse Staking Ratio

(SI) 90 : 10 (FB)