Innobyte AI Ventures

Tech Equities: Up to 6 months

Portfolio Fund Target

~ 29,765

Strategy Focus

Emerging Technologies

Target Size

$990m

Investment Objectives

Intro to Innobyte AI Venture:

- Our billion-dollar Hedgefund, is at the forefront of AI investments. With a laser focus on the UAE, Asia, and North America, we are poised to harness the full potential of the AI sector and its supply chain, positioning our investors at the epicenter of innovation.

- Committed to responsible investing, we target AI technologies that not only drive profitability but also contribute to sustainable development across diverse industries. Our investments span the entire AI supply chain, from cutting-edge startups to established industry leaders, ensuring a comprehensive approach to wealth crea:tion and innovation.

- Backed by a team of AI experts and regional specialists, we leverage deep industry knowledge to identify and capitalize on transformative opportunities. With a billion-dollar investment mandate, we are primed to lead the charge in shaping the future of AI-driven technologies, making meaningful impacts on global markets and the future of wealth.

Benefits to Investors:

- High net worth clients often have unique financial goals, risk tolerance levels, and tax considerations. This fund offers the flexibility to tailor investment strategies to individual needs, allowing high net worth individuals to optimize their portfolio based on their specific circumstances.

- High net worth investors gain direct access to exclusive investment opportunities in the AI sector and its supply chain across key regions. They can participate in early-stage funding rounds of promising AI startups and explore co-investment options, potentially capitalizing on groundbreaking innovations.

- The fund can provide personalized wealth management services, including tax optimization, estate planning, and legacy-building strategies. High net worth investors can leverage these services to maximize their returns, minimize tax liabilities, and ensure their wealth is preserved and passed down efficiently to future generations.

Fund Pioneers:

-

Dr. Emily Chang, Fund Visionary: Dr. Emily Chang, a visionary leader in the AI sector, laid the foundation for this pioneering fund. With a Ph.D. in Artificial Intelligence and a successful track record of launching tech startups, she recognized the transformative potential of AI. Her vision ignited the creation of this fund, setting the stage for innovative investments in the AI supply chain.

-

John Roberts, Regional Strategist: A seasoned strategist with over two decades of experience in international markets, John Roberts plays a pivotal role in shaping the fund's global expansion. His expertise in bridging cultural and regulatory gaps across regions ensures the fund's success in the UAE, Asia, and North America.

-

Michael Thompson, Wealth Management Advisor: Michael Thompson specializes in high-net-worth wealth management, providing tailored strategies for individual investors. His attention to detail and tax optimization expertise offer high-net-worth investors personalized solutions.

Highlights

Investment Structure

Pioneering AI Innovation:

Our foremost goal is to pioneer AI innovation across the UAE, Asia, and North America. We seek to identify, invest in, and nurture cutting-edge AI technologies, from groundbreaking startups to established industry leaders. By supporting and amplifying AI innovation, we aim to drive transformative change across various sectors and deliver substantial returns to our investors.

Strategic Regional Focus:

With a strategic focus on key AI hubs, we aim to leverage the unique strengths and opportunities presented by the UAE, Asia, and North America. These regions are known for their technological prowess, regulatory frameworks, and cultural diversity, making them ideal breeding grounds for AI advancements. Our objective is to position our investors at the forefront of this innovation wave.

Responsible AI Leadership:

Beyond financial gains, we are committed to responsible AI leadership. Our investments align with environmental, social, and governance (ESG) criteria, reflecting our dedication to ethical AI practices. We strive to foster sustainable development, ethical AI adoption, and long-term profitability.

Customized Wealth Growth:

Recognizing the diverse needs of our investors, we offer tailored investment strategies within the fund. High-net-worth individuals can benefit from personalized wealth growth plans, tax optimization strategies, and estate planning services. Our objective is to optimize returns while aligning our investment approach with individual financial goals.

Global Impact:

We aspire to make a global impact by strategically investing in AI technologies that not only drive profitability but also contribute to sustainable development goals. Through our investments, we seek to address critical global challenges, including healthcare innovation, environmental conservation, and technological inclusivity.

Expert Management Team:

To achieve these objectives, we rely on an expert management team with deep knowledge of the AI landscape and regional dynamics. Their combined expertise, extensive network, and market insights guide our investment decisions, ensuring that we remain at the forefront of AI innovation.

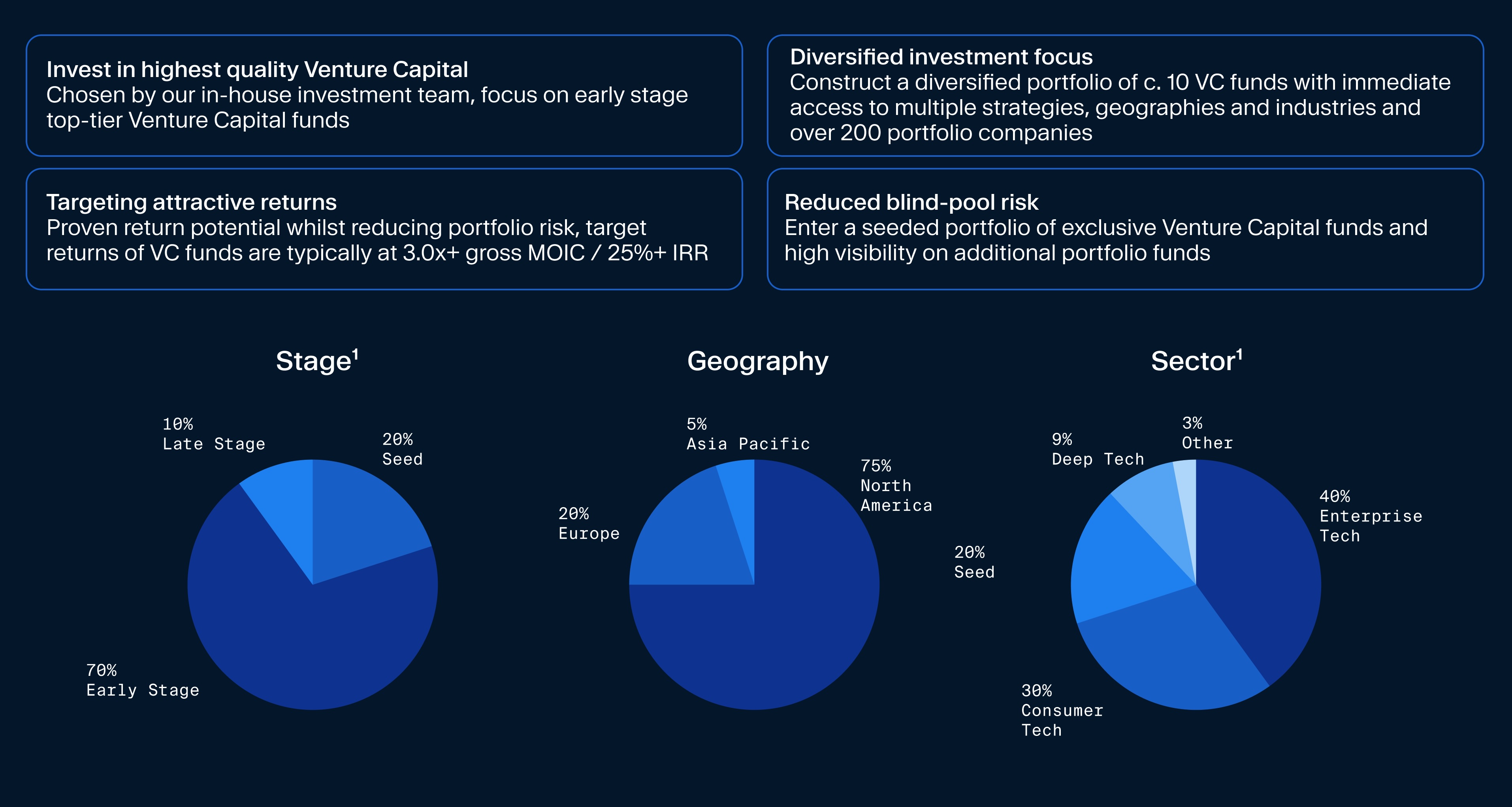

Illustrative Portfolio diversification

-

INVESTMENT NAME

Innobyte AI Ventures

-

Strategy

Emerging Technologies, Portfolio

-

Geography

North America, Asia, Europe

-

Investment Period

Up to 6 Month

-

Closing date

2027-02-05

-

Min. Investment

$1,500,000

-

Max. Investment

$3,499,999

-

Surge Percentage

1.80 %

-

Surge Duration

12 Week(s)

-

Tri-Weekly Dividend

0.95% - 1.15%

-

Min Withdrawal

$100

-

Max Withdrawal

$500,000

-

Staking Interest

1.50%

-

Diverse Staking Ratio

(SI) 60 : 40 (FB)